The metaverse has undergone a significant shift in the past few years. The initial wave of excitement from 2021-2023 led to major investment, but by 2024, scepticism grew as some platforms struggled to retain users. Headlines suggested the metaverse had failed, with brands pulling back or refining their strategies.

However, this is more of an evolution than a collapse. The focus has moved from speculation and over-promised potential to a practical evaluation of platforms, engagement strategies, and return on investment. This article explores where the metaverse stands today, how people are engaging, and what brands should consider when entering this space. Our insights are based on real project briefs, industry discussions, and hands-on experience in creating digital activations.

The Current Climate: How Are People Engaging?

WHAT WE HAVE SEEN

We’ve worked with brands exploring metaverse activations across different platforms, and the ones that truly resonate are those that align with how users naturally engage. Simply existing in a digital space isn’t enough—brands need to offer experiences that encourage return visits, whether through community-driven elements, interactive storytelling, or mechanics that feel intuitive. Some activations feel like marketing experiments rather than meaningful interactions, and audiences can tell when a campaign lacks depth. The key question brands should ask is whether their activation genuinely creates engagement or is just taking up digital space?

The Purpose of the Metaverse

If you’re not familiar with these terms—or haven’t logged into LinkedIn in years—here’s where things stand.

The metaverse spans social spaces, gaming, enterprise collaboration, and digital economies. Roblox and Fortnite are dominant for brand activations, while businesses use Microsoft Mesh and Nvidia Omniverse for virtual meetings, training, and industrial applications.

Horizon Worlds is expanding its e-commerce capabilities, while blockchain-driven platforms like Somnium Space and Virtua explore digital ownership models. Brands seeking full creative control often turn to Unreal Engine and Unity to build bespoke, highly interactive experiences. The right choice depends on whether a brand wants mass-market reach or a curated digital space.

Meta’s Renewed Commitment

Meta remains a key player, but its approach is shifting. In an internal memo, Meta’s CTO Andrew Bosworth described 2025 as a make-or-break year for their metaverse ambitions. Despite Reality Labs reporting a $17.7 billion operating loss in 2024, Zuckerberg remains committed, citing stronger-than-expected Quest headset adoption and increased engagem neta is now integrating AI-driven improvements, refining avatars, and making world-building tools more accessible. Whether this pays off remains to be seen (Business Insider).

Brand Activations: The Current Landscape

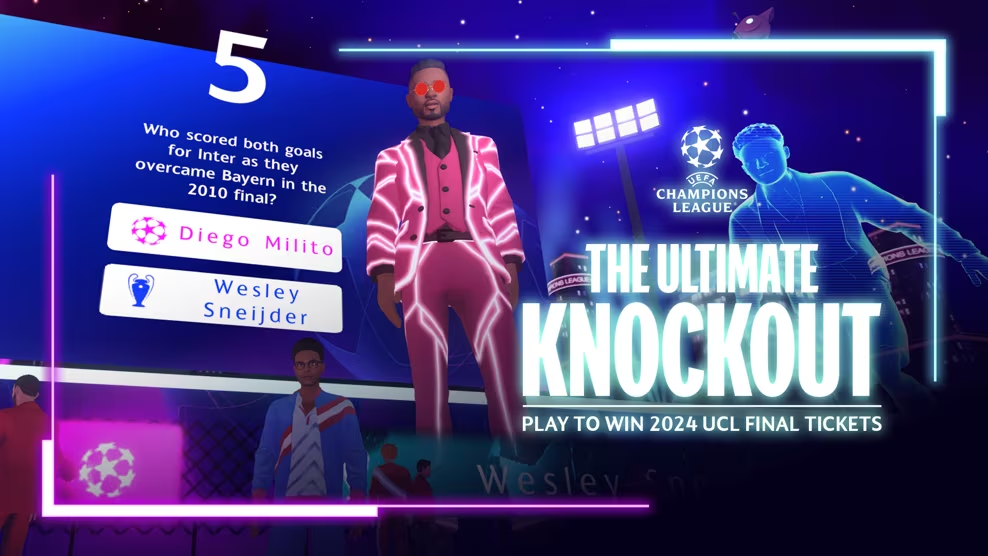

Our own work has demonstrated the power of well-executed metaverse experiences. The UEFA Ultimate Knockout project, developed in partnership with UEFA and Wasserman, is a prime example of how to engage audiences in a meaningful way. By allowing fans to create personalised avatars, compete in football trivia, and win real-world prizes like Champions League Final tickets, this activation tapped into existing fan behaviours and built engagement over multiple seasons. The interactive elements and real-time updates kept fans returning, ensuring longevity beyond a one-off campaign.

Similarly, our RSA Virtual Learning initiative leveraged 3D spaces to deliver immersive road safety education. Instead of passively consuming content, students could engage in interactive scenarios that demonstrated real-world consequences, making learning more effective. This highlights the importance of interactivity and narrative-driven engagement when crafting metaverse experiences.

Metaverse brand engagement is not slowing down. By mid-2024, over 700 brands had executed more than 1,200 activations across platforms like Roblox, Fortnite, and Minecraft—a 58% increase from the previous year (The Interline).

Gamefam, a leader in branded metaverse content, facilitated over 2.7 billion brand engagements in 2024 through activations like Sonic Speed Simulator, a collaboration with SEGA that became the most successful branded game on Roblox, surpassing one billion visits (VentureBeat).

Fashion brands have also seen success. Gucci Town on Roblox continues to evolve, allowing users to engage with fashion-inspired mini-games and digital wearables. Hugo Boss launched an interactive experience tied to virtual fashion shows, while Versace’s Mercury sneaker drop in Fortnite set a new standard for digital fashion activations (Vogue Business).

Evaluating the Investment: Is It Worthwhile?

The metaverse market is projected to grow from $130.5 billion in 2024 to $203.7 billion in 2025 at a 44.4% CAGR (StartUs Insights). Despite this, brands must assess whether metaverse activations offer real value. Rather than simply tracking views, the real measure of success is in how users interact, return, and engage.

We often discuss with clients whether their investment aligns with business objectives. Is it driving meaningful engagement? Does it create something unique that audiences want to be part of? Are the results measurable in ways that go beyond vanity metrics? The best activations don’t just exist—they drive real interactions and brand impact.

Our Final Take

We speak to brands regularly about whether the metaverse is the right move. Brands that see success in the metaverse are those with a clear purpose and a long-term approach, rather than those chasing trends. The brands that succeed are those that treat metaverse activations as part of a bigger digital strategy. The ones that fail are the ones that expect instant results from a single campaign. The technology will evolve, but engagement fundamentals remain the same—if an experience doesn’t draw people back, it won’t deliver long-term value.